How Credit Cards Work in Budgetwise

Contrary to most other budgeting software, credit cards are treated quite differently than just another account.

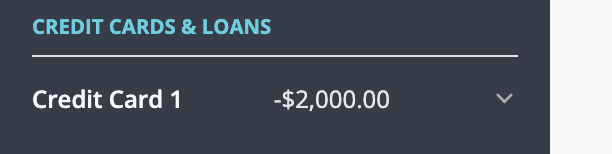

For starters, when you add a new credit card, any balance you currently have on it will display as a negative number, indicating that you actually owe that money.

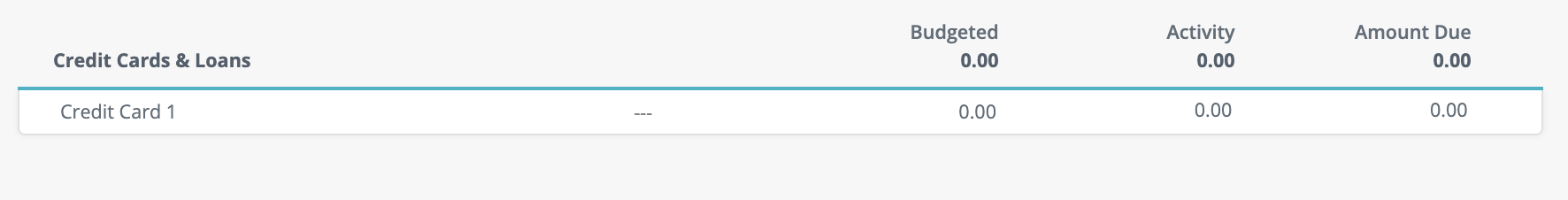

Also, any credit card or debt-type accounts that you create will be automatically added to a special “Credit Cards & Loans” section on the Budget page.

The reasoning behind this is that if you have any debt, you should be taking that into consideration as well when creating your budget. By including it in the budget screen, you’ll be able to budget the entire amount if you pay it off each month, or whatever amount you are comfortable putting towards paying down your debt.

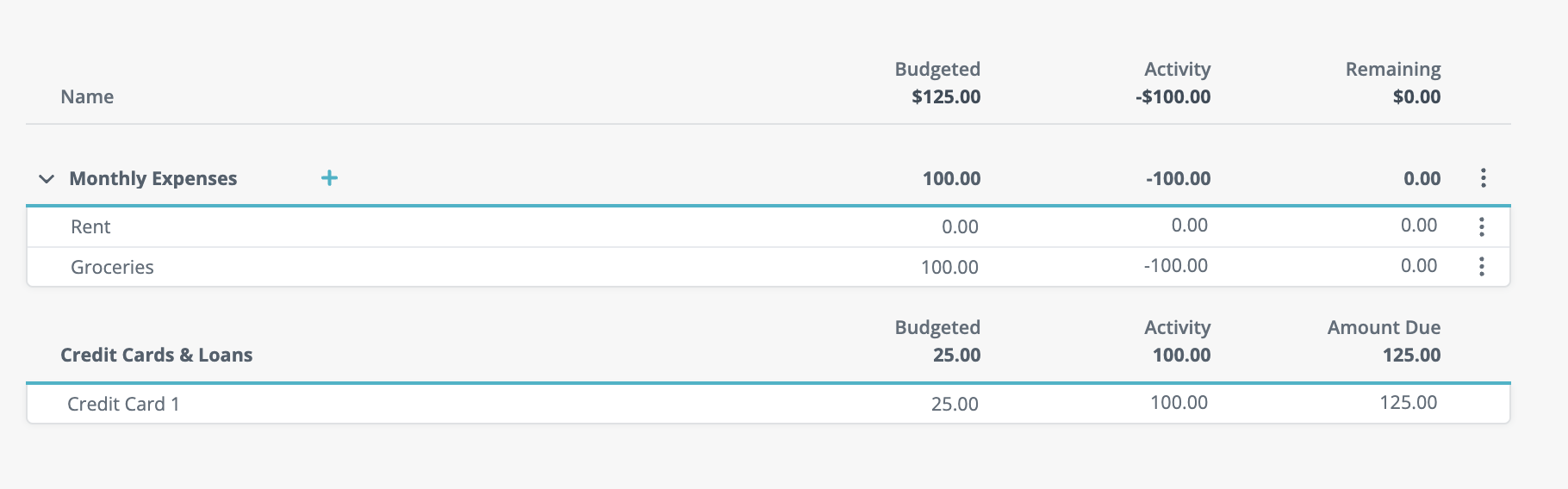

The columns for the credit card/debt section are also a little different than the other budget categories. They are split up into three columns:

Budgeted - The amount of extra money you’d like to put towards paying down this debt

Activity - Any transactions that have occurred in this account

Amount Due - The total amount due this month in order to be caught up with your credit card or debt expenses

A Real World Example

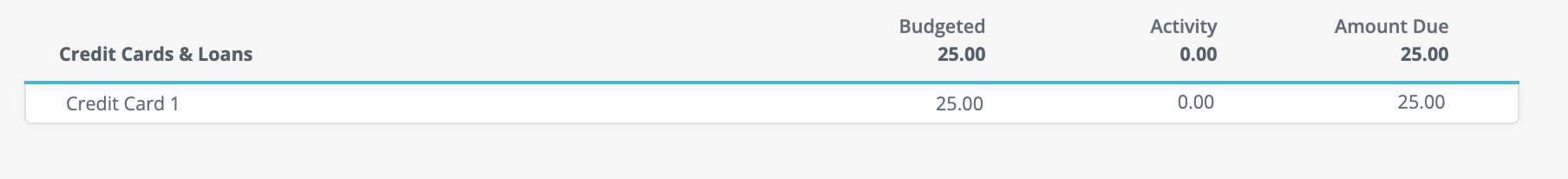

The best way to learn how to use a tool is by seeing real examples, so let’s dive into it. Imagine you have a single credit card we will call Credit Card 1, and you have been making only minimum payments of $25 on it each month, and need to continue to do so for the foreseeable future.

Let’s go ahead and budget $25 towards that card. The screen will now look like this:

As the screenshot depicts, you will now notice that the Amount Due has increased by the amount you added to the Budgeted column.

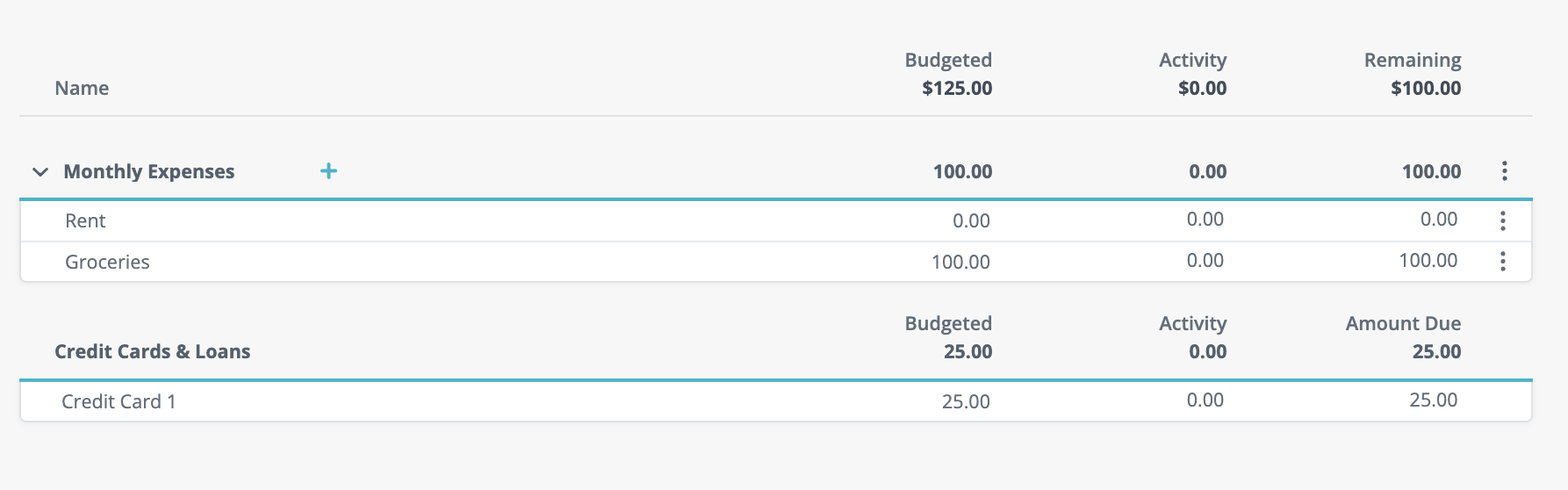

Now, let’s say we have a regular budget category called Groceries and we have budgeted $100 towards it. Our budget categories will look like this:

So, you’ve budgeted a total of $125, but you have $100 remaining. This is one key behavioral change regarding credit cards - if you budget any amount towards debt, it won’t count it in your Remaining totals so you don’t accidentally overspend. Thinking about it in plain terms can help clarify this point: if you need to spend $100 on groceries and $25 on debt minimum payments, you are budgeting a total of $125 dollars but only have $100 to spend through transactions (the groceries).

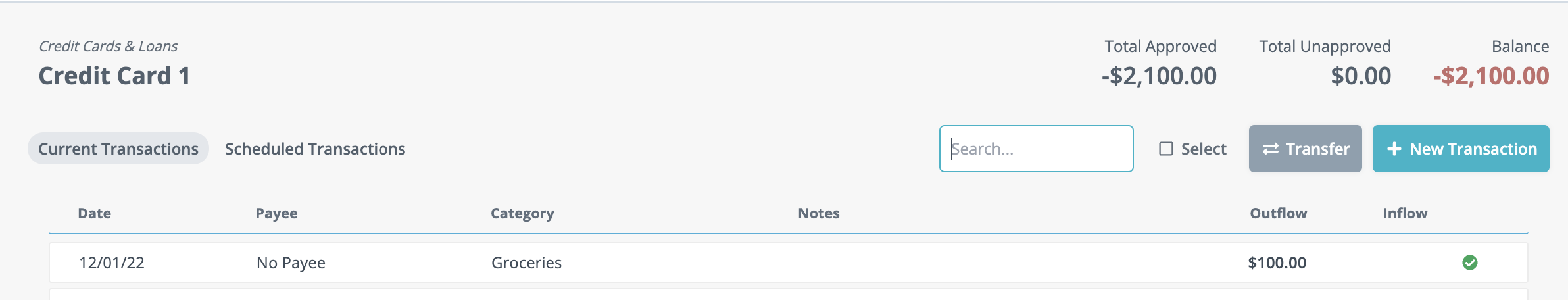

Continuing on, let’s say hypothetically that there aren’t enough funds to cover your groceries budget, so you need to use your credit card. Let’s go ahead and make a transaction in our credit card’s account page, and give that transaction a category of Groceries.

Now let’s go back to the budget page to see how it’s changed.

There are several things that happened here:

- The Activity column in the regular budget category section reflects the outflow of -$100

- The Activity column in the debt section shows that you’ve increased your card balance by $100.

- The Amount Due now went from $25 to $125, because if you are trying to avoid going into further debt, you will need to pay $125 towards the card to cover the initial budgeted amount plus any activity you put on it. If you cannot make the full payment, the difference will carry over into next month’s budget so that you can take it into account at the start of the month and plan accordingly.

There are many areas of flexibility to cater to your own specific needs or requirements. You can leave the Budgeted field empty and just pay whatever amount you spent on the card, or don’t use it for any spending activity and just budget money towards paying it down.

Understanding how credit cards differ in Budgetwise will help you get started on the right foot, and if you are looking to pay down or eliminate your debt, having this type of system will ensure you don’t end up overspending on your credit accounts.